Financial Planning & Analysis (FP&A) department is responsible for the financial decisions of any company or institution. AI-enabled Predictive Analysis is a recurring or growing branch in the Banking & Finance sector. Due to the recent pandemic situation in 2020-2022, numerous organizations have discovered flaws in their financial, planning, and analyzing procedures or systems.

Traditional planning methods have the drawback of preventing finance teams from working on tasks with a greater return on investment because they keep them too occupied gathering data. Inaccurate results are produced when outdated technology is used in conventional forecasting, which in turn slows down the decision-making process.

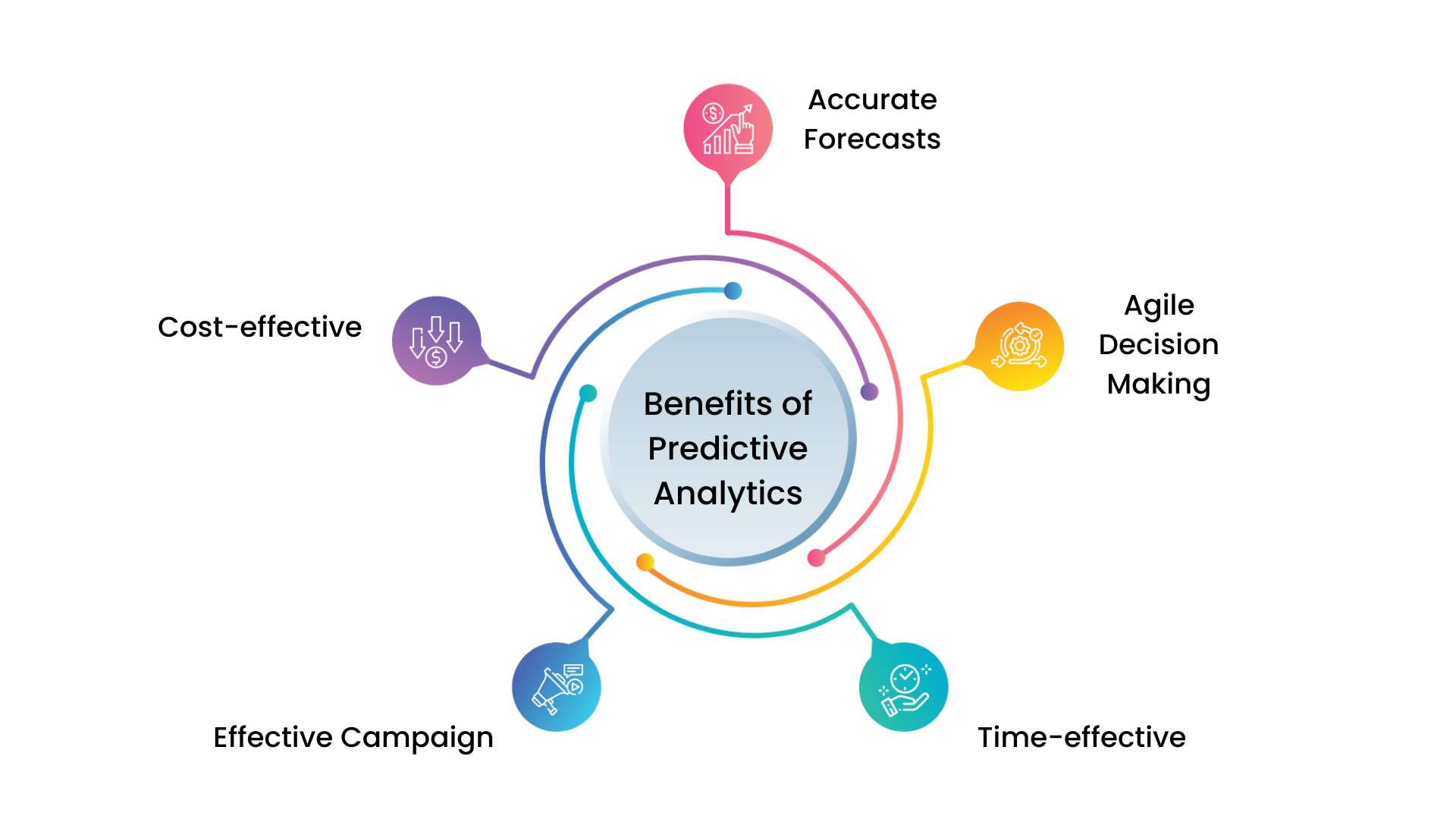

Predictive analytics can make it easier for finance teams to make correct decisions in the field of financial planning, assisting them in achieving their organizational objectives. Financial data can be utilized to uncover trends using AI-based predictive analytics for better planning, forecasting, and decision-making.

CFOs can leverage AI-based predictive analytics to study historical data and get smart insights from the same. The key to improving forecasting is to use cloud accounting software, which automatically adjusts estimates to account for changes in the market or incorrect assumptions and collects real-time data from sources across the organization.

Predictive analytics enables the prediction of future events and outcomes by utilizing sophisticated data analytics techniques. This method's flexibility, thoroughness, and data-drivenness enable both executive decision-making and broad planning.

Instead of only collecting data, finance professionals can then concentrate on analysis and facilitate informed business decisions. Through the use of this "seeing into the future" skill, finance teams can foresee mission-critical activities that influence the organization. These activities include studying consumer patterns, supply and demand, and sales trends.

Economic downturns cannot be entirely avoided, but adopting predictive analytics can help prepare organizations better. Businesses that use and analyze data to forecast and discover scenarios will ultimately benefit in the long run since their forecasting skills will improve.

With the help of Artificial Intelligence & Machine Learning, finance teams can get insights to respond to inquiries, spot patterns, and analyze data while performing strategic planning and take important business decisions.

Predictive analysis techniques can be applied manually or with the aid of machine-learning algorithms. Both strategies make predictions based on historical evidence. By combining forecasting and predictive analytics, finance teams can develop more data-informed strategies based on truth rather than assumption.

One must maintain regular financial records to accurately anticipate the organization's future success. The future of the company can be predicted in with the aid of AI-based predictive analytics.

Our solution helps predict sales, income, and expenses and enables one to take future decisions based on prior financial statements and history records. To ensure their company's future success, CFOs must plan forward.

Things that can be improved using predictive analytics are given below:

To prevent a liquidity crisis, managing cash flow is essential in preparing a company's future cash requirements. Financial professionals may detect sluggish payers, identify and fix system problems, and enhance receivable management with the help of data insights.

Predictive analytics can be used to define baseline criteria to make it simpler for finance departments to spot outliers before they impair the organization's general performance.

With the help of predictive analytics, it is possible to forecast sales over time and ascertain the level of interest in the product. This will increase profitability by lowering customer returns and product scrapping.

Predictive analytics can be used by finance professionals to get a "sneak preview" of the future financial mid-period and prevent surprises.

Finance professionals may optimize receivables aging processes and effectively collect past-due sums by setting warnings when clients depart from their historical payment habits.

While it is hard to completely prevent economic downturns, predictive analytics can help businesses prepare for them if they do happen.

Forecasting is essential to planning and production in today's corporate environment. Your finance staff won't have to rely on outside resources or waste time manually entering complicated formulas into spreadsheets for data-driven planning if you choose our AI-based predictive analytics.

Cloud accounting software collects real-time data from numerous data sources across the organization and automatically re-predicts to account for changes in the market or incorrect assumptions. The finance staff is therefore more concerned with analysis and business choices than data collection.

With data-driven predictive analysis, your finance team can confirm, improve, and review financial decisions, reducing the chance of mistakes and increasing the chance of wise and useful judgments.

Automated predictive analysis and machine learning algorithms are used to compare, analyze, and convert data in real time. Finance teams will have more time to devote to the value-adding activity of making agile finance predictions by utilizing real-time analysis thanks to the automation of manual operations.

More options than ever before are available to consumers today. By analyzing the data you have available, such as purchasing habits, buying behavior, and web browsing, you can decide when and how best to run marketing campaigns. You may reduce excessive expenditure and increase the efficiency of your finance team by creating a precise projection.

This strategy minimizes manual data collecting and analysis while enabling cost-effective planning and sourcing. The method can help finance teams with internal policy development, supplier evaluation, and financial budgeting.

As global conveners and collaborators, CFOs should encourage everyone, including executives in IT, sales, and marketing, to own the process. Obviously, CFOs cannot lead digital transformations alone.

We at Daten & Wissen are dedicated to offering both tactical and strategic advice to position your business for future success. Please browse through our various products and services, and make an informed decision before consideration… If it helps, feel free to contact us at 91+ 9820080751.

-min.png)

Written by

Daten & Wissen is the team of expert AI engineers to help your business to embark on a transformational journey with the adoption of this futuristic technology.

EHS risk management is a method of identifying potential environmental and safety hazar…Read more

Production quality and yield are two of the top performance indicators for the manufact…Read more

The market is growing with the increasing demand for CCTV systems as more and more busi…Read more

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can back-out if you wish.